Moneybase offers a multitude of services that help you pay, save and invest with ease and peace of mind. Our payments and investments app is tailored to your needs and designed to make money simple. You can send and receive payments in a flash, trade on the go and monitor your spending with real-time notifications, all from the same app, available for download here.

Setting up and verifying your account is a straightforward process which will only take a few minutes, but you can read this guide if you’re still getting started. Once you’re set, you will be able to access and top up your account, as well as send and receive payments from your phone. Continue reading to learn all about how to do just that.

Contents:

- Your account

- How to top up

- Making payments

- How safe are online payments

How do I check my account?

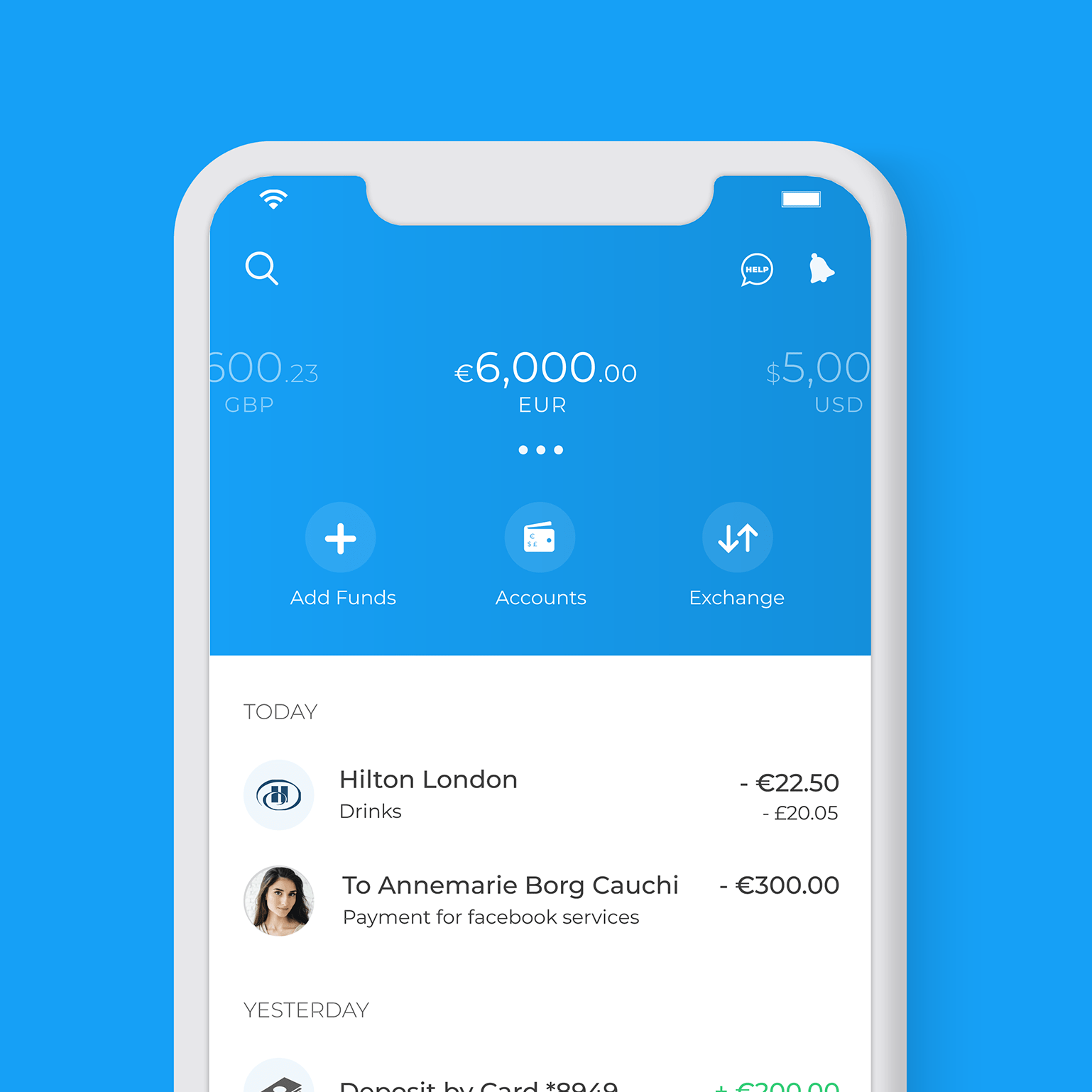

Once you download and log in to your app, you will see the current amount in your account. You can swipe right on the top half of the page to view any funds you have in other wallets with different currencies. You can also exchange money from your e-wallets at the best exchange rates available, with no hidden fees.

To create another account, just tap on the 'Accounts' tab and then select the 'Add an account' option.

How do I top up?

The ‘Add Funds’ icon will give you two options for topping up your account. You can carry out a bank transfer or make an instant deposit through your Visa or Mastercard.

Bank Transfer

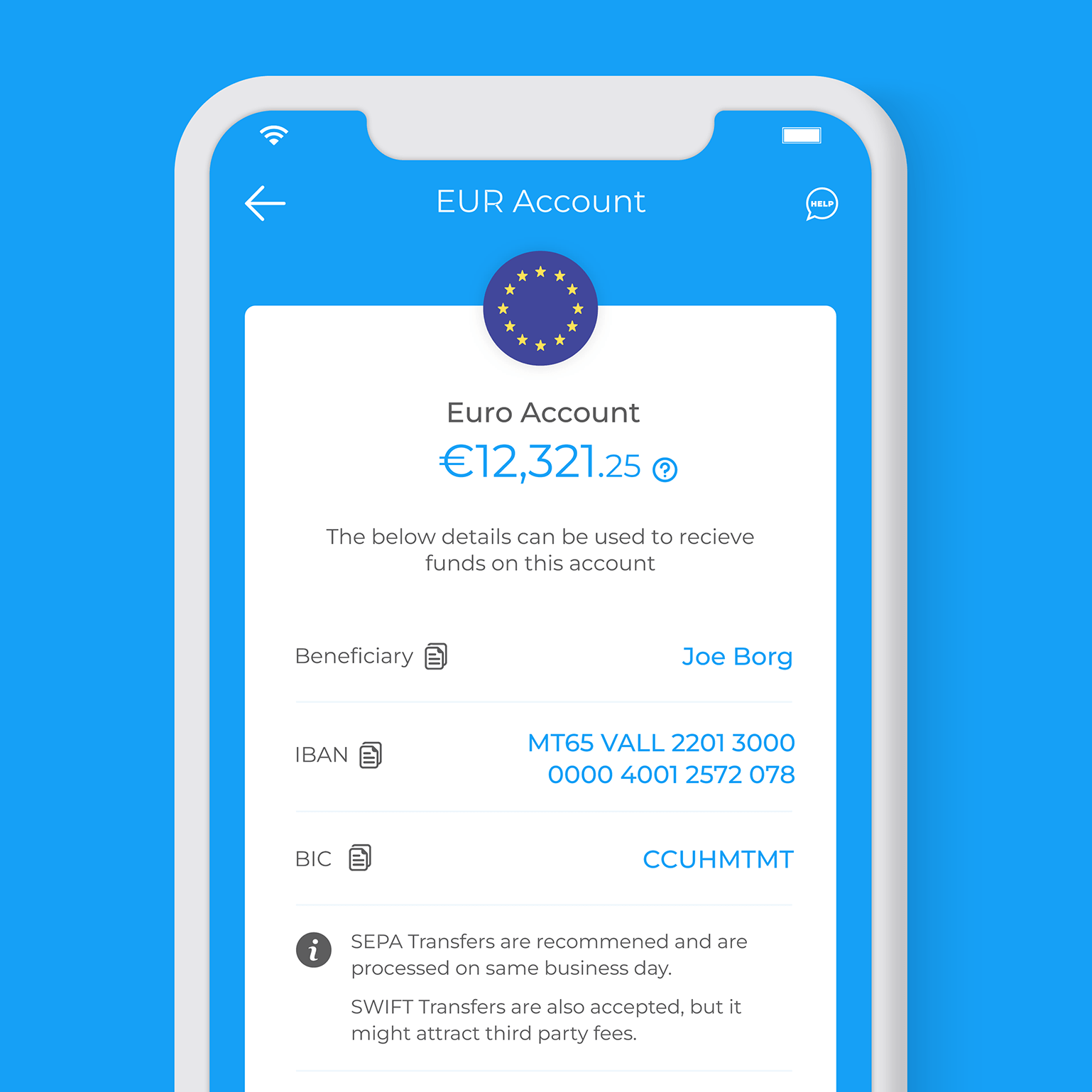

This option allows you to transfer money from another account to your Moneybase IBAN. When you tap on ‘Bank Transfer’, you will be redirected to the information you require in order to receive funds on your Moneybase account. SEPA transfers are processed on the same day and SWIFT transfers are also accepted. You can also tap the ‘Share’ icon at the bottom to pass on your details in full, or tap the copy icons next to the required data in order to input your IBAN or BIC on another page.

With Moneybase, you will have your own personal IBAN, which means that you can choose to receive your salary on your Moneybase account as well. This way, you can streamline and manage your finances from the same app. Real-time notifications and full visibility of your transaction history allow you to keep track of your finances as you spend or save.

Credit/Debit Card

The second method enables you to top up your account instantly. You can make on-the-spot deposits using a Visa or Mastercard you have linked to a separate bank account. To do this, you will only need to enter your card details for the first transfer.

There are no charges on the first €500 top-up you make each month, which you can add in instalments that suit your needs. Any card deposit fees following that will be shown on your screen before you confirm the top-up.

Now that you know all about how to keep your funds in check, you’re probably wondering how you can send and receive payments through the app. Here are your questions answered.

How can I make a payment?

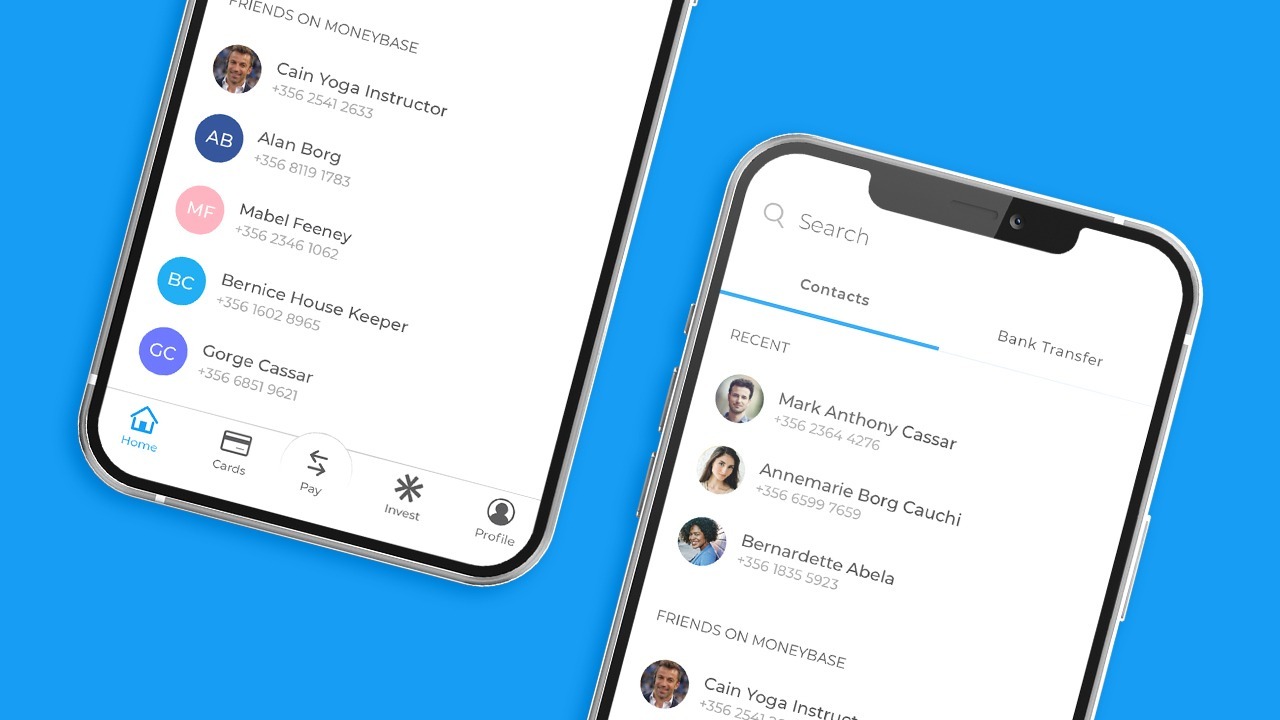

To send and receive payments, tap the middle payments icon at the bottom of your screen.

Now you can choose whether to send money to a bank account or to someone from your contact list.

How do I make a bank transfer?

By tapping ‘Bank Transfer’, you can add the bank account details for accounts belonging to you, to someone else, or to a business. Once again, have the IBAN and BIC or SWIFT code ready. You can personalize the account name as well, especially if you will be using this account regularly.

What are P2P payments?

An even faster method is the person-to-person (P2P) payment option you get if you tap on ‘Contacts’. In this manner, you will be able to send money directly to other contacts from your phone using the Moneybase app. If you want to pay someone who is not using the app, you can also invite them to sign up.

Read more about P2P payments here.

How safe are online payments?

While you probably find the digital nature of these transactions to be very practical, you might be worried about security issues. However, rest assured; the app comes with robust security features that keep your money as safe as you want it to be.

Since Moneybase is not a bank, your money will not be lent out and used to issue loans, which means your money’s risk exposure is low when compared to a traditional bank. Moneybase is not required to contribute towards the Depositor Compensation Scheme either. All customer funds held on Moneybase are banked with reputable banks in the European Union in duly designated segregated client accounts, in accordance with our legal and regulatory obligations as a licensed Financial Institution, which are intended to safeguard your account and protect your money.

If you have some reservations about giving your money a virtual home, here are some top questions we have answered for you in order to set your mind at rest when it comes to any security concerns you may have.

And here’s a recap:

- One app for payments and investments

You can switch from payments to investments in just one tap from the bottom of your homescreen. - Add funds in different currencies

From your Moneybase homescreen, you can top up in two different ways and keep wallets in a range of currencies. - Payments

You can make bank transfers by clicking the ‘Payments’ tab at the bottom of your homescreen.

You can also use P2P payments to send your contacts money or receive payments from them.

In the meantime, we’re always here to help. If you need further assistance, you can use our in-app chat, available seven days a week, or contact us on +356 25 688 688.

Moneybase payment services are brought to you by Moneybase Limited (MB) C87193, which is licensed by the MFSA to transact the business of a Financial Institution in terms of the Financial Institutions Act, Cap 376. Moneybase Invest and all investment services are brought to you by Calamatta Cuschieri Investment Services Ltd (CCIS) C13729 and is licensed by the MFSA to undertake investment services business under the Investment Services Act, Cap 370.

Moneybase Invest offers direct market access and speed of execution and is intended for knowledgeable and experienced individuals taking their own investment decisions. The value of investments may go up as well as down and investors might not get back the original amount invested. The contents of this article are not intended to be taken as a personal recommendation to invest but strictly based on research and for information purposes only. Investors should contact their financial adviser for a suitability assessment prior to taking any investment decisions.

MB and CCIS are both subsidiaries of the CC Finance Group plc with their registered address situated at Level 0, Ewropa Business Centre, Dun Karm Street, Birkirkara, BKR 9034, Malta. www.moneybase.com