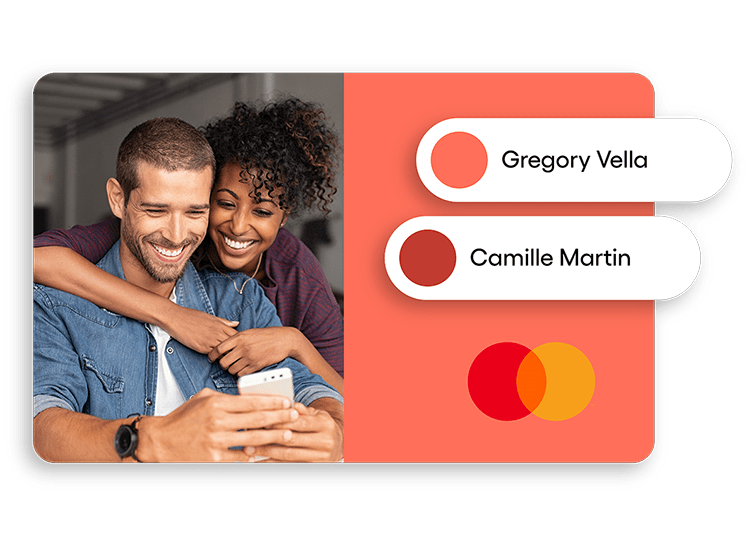

Money's better together.

Moneybase Joint Accounts

One app, multiple accounts

Your joint account is separate from your individual account but just as easily accessible, and you can share this account with up to two more people.

Shared spending and savings

Manage and monitor your shared expenses or save up together for a particular goal. Set up a joint account with your partner, relative or friend for your household bills or to start saving for a rainy day.

The benefits of a joint account IBAN

Your joint account comes with its own IBAN for separate transactions so you can add funds directly to it or even receive your salary on it, without having to transfer funds from your main account.

Get joint account cards

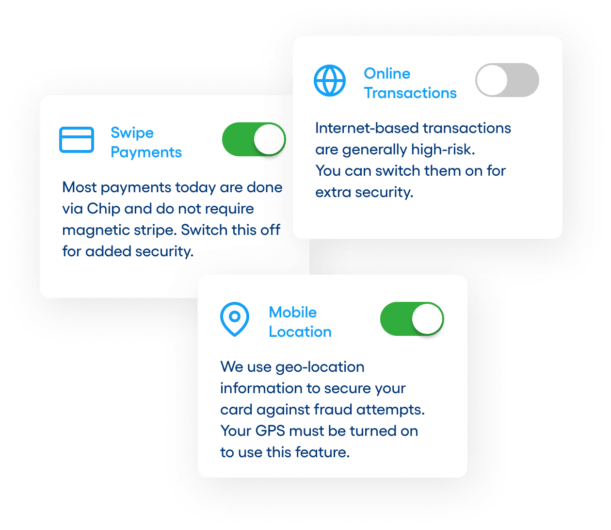

Joint account holders can order a separate card linked to the joint account for direct withdrawals. You can control your card’s security features straight from your phone and freeze or customise your transaction settings to suit your needs.

Full visibility, real-time notifications

Keep track of your spending and savings with your joint account transaction history and real-time notifications for incoming or outgoing funds to see who’s spending what.

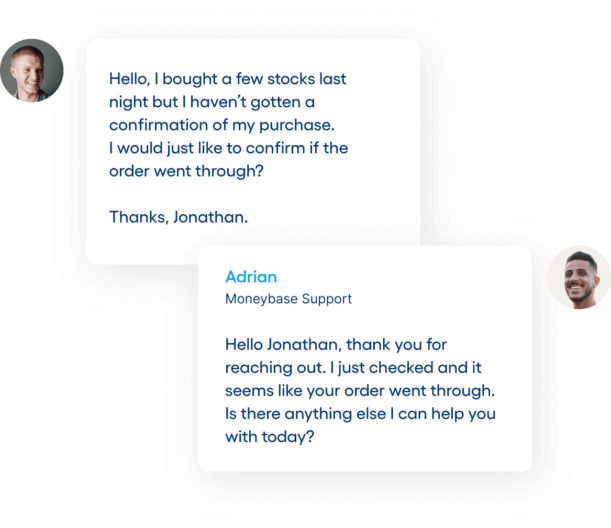

Setting up a joint account is easy

No need to set an appointment or fill in complicated paperwork. All you need to do is make sure you download the app and sign up. Then get in touch and we’ll handle the rest.