In our tech-driven world, we are already familiar with the idea that our smartphones have become an extension of our physical, real-life existence. Covid-19 and the worldwide lockdowns it led to sped up the digitization of many features of our lives, from working-from-home setups to the increase of services that have suddenly been made available online.

With financial technology, the heightened usefulness of our mobile devices extends well beyond our social online presence or the digital accessibility of information, for example. It is the conjunction between money and digitization that has given rise to concepts like electronic money or online payments, which is why we now speak of living in a cashless society. Indeed, the most prominent sign of such a society is that your smartphone replaces your wallet, and not just in terms of online banking or virtual cards.

So now that our societies seem perfectly poised to tip the balance between physical and virtual, analogue and digital, firmly in favour of the latter, let’s have a closer look at what a cashless society is really like and whether there are any threats or concerns to mitigate the seamless convenience it promises.

Main Takeaway: A cashless society makes handling money more convenient, traceable and safer, for all stakeholders involved.

What is a cashless society?

At the till, you no longer need to fish out your purse to count your cash and coins. Surpassing even the ease with which you swipe or tap your cards, imagine just grabbing your phone—which, let’s face it, is always within reach if not actually in hand, anyway—and tapping your phone or scanning a QR code to finalise a payment which is not only cashless but also cardless. If this is familiar to you, then you already know full well what it is like to live in a cashless society.

A cashless society is one where many day-to-day financial transactions are carried out online or electronically, making use of digital payment systems instead of paper money. Such electronic transactions are already prominent in the form of card payments and online banking, but with more recent innovations in fintech taking hold, other uses gaining momentum now include peer-to-peer payments, in which an individual sends money directly to a recipient through a mobile payments app. Even when shopping offline, consumers might use their phone to settle payment by tapping their devices against a point-of-sale system that reads mobile phones instead of cards. A wallet today no longer necessarily signals a physical belonging; rather, we now speak of digital or mobile wallets which may carry electronic money in various currencies, all of which are available on a user’s smartphone. Even more conspicuous to emerging cashless societies is the rise of digital coins as currency or investment opportunities.

Technically speaking, going cashless is not only for the tech-minded among us. Anyone using cards or cheques has already found an alternative way of handing money. However, developments in electronic transactions have brought the technology to our phones and to our everyday lives with a force that is as undeniable as it is appealing, and this change in the way we handle money is probably here to stay. Let’s see why.

What are the benefits of a cashless society?

Convenience

Convenience is the name of the cashless game. As obscure and intangible virtual systems may be, the advantages of going cashless are practical and very much real. The main benefit of swapping paper money for payments via card or smartphone is that regular individuals do not need to carry banknotes around or queue up at ATMs to withdraw money. Transactions can be made simpler and seamless once physical money is out of the picture, so that paying your electricity bills or splitting the restaurant bill with your friends can be done in just a few time-saving taps on your phone.

Visibility

A beneficial side-effect of paperless money is that it is easier to manage your finances. Instead of having to wonder where that €50 note went or just how much you spent in a month, your online bank records or app transaction history are immediately accessible on your phone and help you keep track of your money, whether you’ve been spending or saving it. Having your financial data so easily available can give you the kind of visibility you need for peace of mind and better money management and budgeting.

Inclusion

While some still feel that there is nothing better than the tangible feeling of cold hard cash in hand, paper money is fundamentally insecure, and conducting your finances in purely physical terms is not advisable. If you do not even have a bank account, you are missing out on any attendant interest rates and services—such as the provision of loans—dependent on a traceable financial history, the kind data-free cash cannot provide. An informal cash-based society is ultimately not as financially inclusive as a cashless one, in which individuals are automatically able to tap into a wider cache of financial services.

Security

Not only does going cash-free make life easier for the consumer, but it is also a safer way to handle money. The pandemic has already highlighted the hygiene benefits of electronic payments, but the protection afforded by cashless exchanges goes beyond viral threats. Rather, given the fact that cash is easily misplaced or stolen, going cashless gives you more security against the potential thief who needs to know your PIN number or is trying to unlock your device with biometric authorization. The real-time notifications that come with online payments apps add another layer of protection, as do the security features that come with such platforms.

Crime prevention and detection

Because cash still rules in the underground economy, the security that comes with digital money is not only beneficial for the individual, but it can also help the authorities monitor and prevent crime. Banks can detect and avert fraud much more efficiently when the economic activity in question is not based on paper money. Additionally, governments are also stakeholders in the switch to a cashless economy because non-cash transactions are easier to analyse and convert to data on a society’s economic behaviour. Such data not only helps decrease crime and clamp down on black market activity, but it may also be used to improve tax enforcement efforts and increase revenues. Societies dependent on cash can only provide their government with an incomplete picture of their financial performance.

Better for consumers and businesses

Sellers stand to gain as much as buyers do. Handling cash can be more costly than it needs to be for businesses but cashless transactions bypass this basic hurdle. Once again, since consumer behaviour is more visible when transactions are not made in cash payments, businesses can capitalise on this data by trying to turn it into sales.

From merchants to consumers, individuals to businesses and government authorities, all stakeholders stand to gain from the switch to digital payments.

Does a cashless economy come with any risks or dangers?

Despite the fact that going cashless is not only more convenient but also safer, there are still one or two concerns that we should bear in mind.

The first threat posed by a paperless money will not surprise anyone who is conscious of their digital footprint and how online data is gathered and exploited. As with all online activity, digital payments may leave a number of traces that collectively accumulate and which may be interpreted to garner data about us as consumers—data which we are not necessarily aware of having provided. Such records may vary and depend on how we pay, which platforms we use, which websites we shop at, and the settings on our devices. If we are not careful about the data traces we are leaving behind, some information may be visible to organisations or companies trying to target us with their advertisement.

Beyond the issue of data tabs and ad-targetting, a cashless society also raises important questions about inclusion and exclusion. Those who are not digitally literate may feel they are being left behind as more and more services switch online and human-to-human transactions become rarer. Think of the accessibility challenges faced by senior citizens who still prefer cash and have not even got around to using ATMs, let alone online payments apps.

For this reason, a responsible society needs to ensure that the transition to a cashless economy does not lead to an exclusive hierarchy whereby the discrepancy between the haves and have-nots is aggravated. Some careful planning and training in digital and economic literacy can give everyone the opportunity to turn a cash-free society to their advantage, especially since these financial trends seem to be irreversible.

How close are we to becoming a cashless society?

While we might not be entirely cashless yet, the signs are already omnipresent. Just take a look at how you might settle the restaurant bill with your friend by sending them an electronic payment, or how having your phone on you at all times has become more of a priority than having your wallet just as handy.

If we take Chinese society as an example, it is no surprise that mobile payments have very high penetration there, given that China is a world leader in e-commerce and the country which invented the QR code for quick response payments. In Europe, Swedish society leads the way in terms of the paperless economy. You are more likely to come by a ‘Cash-free’ or ‘Card only’ sign than a ‘Cash only’ sign in a Swedish shop.

Some commentators, however, observe that there is some more that can be done in the sphere of policy-making for banks to draw in unbanked individuals and businesses that are still reluctant about accepting cash-free payments. Issues regarding data privacy and monetary security need to be handled with transparency for the uninitiated to take the next digital step into paperless money. Developments in fintech have certainly helped in this regard. With the way innovation in the field is going, you’re one tap away from carrying out all your economic transactions.

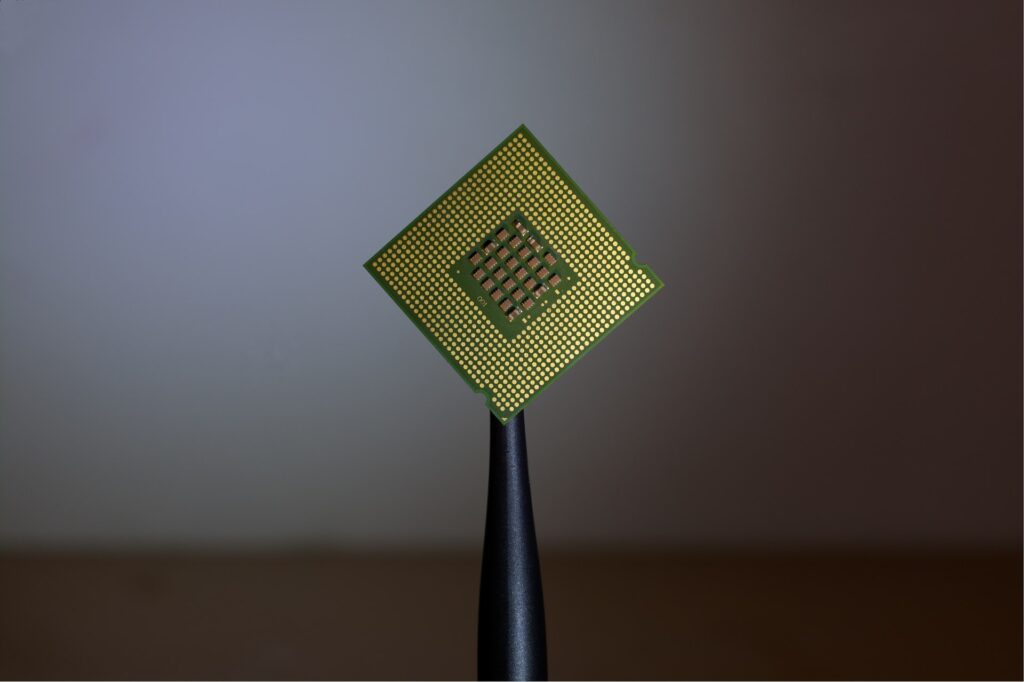

And in a move that seems not only futuristic but positively science-fiction, some are even opting to take the phrase, ‘at your fingertips’, to the next literal level by implanting a microchip in their hands. If you thought online payment platforms were a life hack or that unlocking your phone with your fingerprint was the epitome of security and convenience, this procedure will make you reconsider just how handy—pun intended—biometric technology can really be. This microchip can store all types of identification or authorisation data that allows you to seamlessly carry out a number of tasks just by waving your hand, instead of having to carry around anything from cash to bank cards, identity documents to train tickets, or even different sets of keys.

Going cashless with Moneybase

Don’t worry. You don’t need to commit to getting an implant to enjoy the benefits of going cashless. A mobile phone and internet connection will do just fine. With the Moneybase app (available for download here), you can manage all your finances from just one platform and switch between investments and payments in a tap. Make seamless payments and manage your spending with full visibility, real-time notifications and customisable security settings, straight from your phone.

Once you realise how convenient it is, you will find it difficult to imagine how you’ve ever lived without it, and opening account will only take you a few minutes. Follow our guide on how to get started.

If you need further assistance, our human support team is always available to answer your questions anytime, any day. Our in-app chat manned by real humans is available seven days a week, while our team can also be reached via telephone or email. Whether you need to solve a problem, tap into our expert insights, require help to navigate the ups and downs of the markets or have a banking issue, we’re here for you every step of the way.

Moneybase payment services are brought to you by Moneybase Limited (MB) C87193, which is licensed by the MFSA to transact the business of a Financial Institution in terms of the Financial Institutions Act, Cap 376. Moneybase Invest and all investment services are brought to you by Calamatta Cuschieri Investment Services Ltd (CCIS) C13729 and is licensed by the MFSA to undertake investment services business under the Investment Services Act, Cap 370.

Moneybase Invest offers direct market access and speed of execution and is intended for knowledgeable and experienced individuals taking their own investment decisions. The value of investments may go up as well as down and investors might not get back the original amount invested. The contents of this article are not intended to be taken as a personal recommendation to invest but strictly based on research and for information purposes only. Investors should contact their financial adviser for a suitability assessment prior to taking any investment decisions.

MB and CCIS are both subsidiaries of the CC Finance Group plc with their registered address situated at Level 0, Ewropa Business Centre, Dun Karm Street, Birkirkara, BKR 9034, Malta. www.moneybase.com